Direct Connection to Turnkey Real Estate Investment Professional Operators

Access Our FREE eBook Now!

Download Our Free eBook by submitting the info below

ABOUT US

Dreamstone Investments is a multifamily real estate investment firm that focuses on creating passive income and equity appreciation for its investors through purchasing multifamily properties in secondary and tertiary markets with key indicators showing high-quality investment opportunities.

Become an INVESTOR

Register for Access

Review Exclusive Deals

Make An Investment

How It WORKS

1

PICK A PROPERTY

2

FUND YOUR INVESTMENT

3

COLLECT QUARTERLY DISTRIBUTIONS

4

COLLECT YOUR SHARE OF THE UPSIDE

5

UTILIZE YOUR YEARLY TAX BENEFITS

Core – Yield

- Risk Profile: Low

- Property Type: A & B Assets, A & B Locations

- Average Return: Cash Yield: 6%-10% Annually; 10%+ in Some Cases Equity Multiple: 1x-1.5x IRR: 8%-12%+>

- Hold Period: 5 – 10 Years

Value Add

- Risk Profile: Medium to High

- Property Type: A, B & C Assets, A, B & C Locations

- Average Return: Cash Yield: 6%-10%+ Annually; 10%+ After Stabilization Equity Multiple: 1.5x-2.0x+ IRR: 12%-18%+

- Hold Period: 3, 5 or 7 Years

Opportunistic

- Risk Profile: High

- Property Type: A, B, C & D Assets, A, B, C & D Locations

- Average Return: Cash Yield: 10%+ Yr One or Later Equity Multiple: 2.0x-3.0x IRR: 20%+

- Hold Period: 3, 5, 7 or 10 Years

How It WORKS

1

Schedule a Call with Dreamstone to create your portal access

2

Create Portal Account

3

Fund Your Invest

4

Collect Distributions

5

Utilize Your Yearly Tax Benefits

Acquisition

Current Portfolio Value

Units and Growing

Acquisitions Total

In Renovations Managed

In Equity Raised

Opportunities

Gain access to apartment investment properties by joining our Dreamstone Investor community.

Investment

Using proprietary software, we Analyze, Finance, and Exit the investment for you

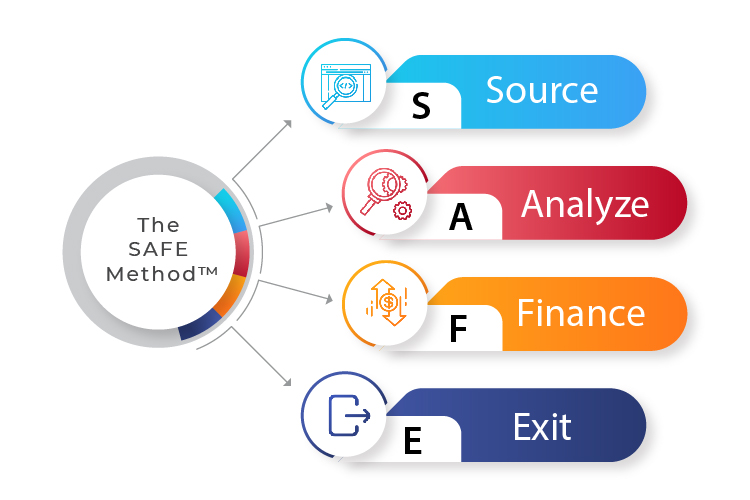

The SAFE Method™

At APTVEST

We Are Proven Professional Operators

With over 35+ years of combined professional apartment investment experience and watching greedy unprofessionals in the apartment investment industry, we understand your need to take as much risk off the table as possible.

This is why we created a vertically integrated platform that offers you equal access to apartment community investments via The SAFE Method™.

The SAFE Method™ stands for Source, Analyze, Finance and Exit and is the proven rigorous filter we use to qualify opportunities. By bringing the three most critical components under one roof – Investment, Construction and Management – we cover all bases relating to the investment and operation of multifamily real estate.

In summary, at APTVEST, we know apartment investing!

Our Promise

You Deserve Access to

Transparent Apartment Investment Opportunities

Benefits of Investing With Dreamstone Investments

EARN PASSIVE RETURNS

OF 5% to 25%

INVESTMENT

MONITORING

QUALITY DEALS

PORTFOLIO

DIVERSIFICATION

EARN PASSIVE RETURNS OF 5% to 25%

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

QUALITY DEALS

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

INVESTMENT MONITORING

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

PORTFOLIO DIVERSIFICATION

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Our TEAM

Acquisition Specialist

CPA & Operations Manager

Our PORTFOLIO

Clients TESTIMONIALS

Keep Up With Us

& Stay Up To Date On Everything Real Estate